An exciting keytango project with extraordinary prospects.

2021 Cryptocurrency has seen cryptocurrency rise to uncharted highs and this is true not only reflected in the market. Away from exchanges and OTC desks that set Cryptocurrency prices, the interest of private and institutional investors is growing rapidly.

KeyTango?

An exciting keytango project with extraordinary prospects. Good start and confident, big team interested in fast and strong project development.

It is sure to be a successful project because it has a great team that is more than qualified and focused on making this project a success. This project is managed by an experienced and qualified team who are able to take the project to the highest level in no time.

All project success is tied to their team. Very interesting project with specific goals and a worthy team that will definitely achieve its goals.

An extraordinary project with great potential and a strong team. This project has a clear development strategy that will allow the developer to work confidently to improve the platform.

An extraordinary project based on the latest extraordinary super technology.

KeyTango is a platform for retail investors to find, learn about and invest in DeFi products and services such as crop farming and liquidity pools. We believe DeFi is meant to be, and should be more inclusive.

and the keyTango team consists of MIT alumni, Ycombinator and Enigma MPC. This team is supported by Outlier Ventures.

Future Easiest Keytango Defi?

keyTango is a Web3-based application created for those struggling with complex UI / UX visible directly from the Bloomberg terminal, which acts as a seamless gateway to popular DeFi products and services ready to unravel in a few clicks. Unlike YFI, who is quite familiar with Deep DeFi, we offer an easy-to-understand and navigate UI / UX, which empowers you with customized content and suggestions based on your experience level and blockchain history.

In today’s series, we’re taking a closer look at some of the key concepts in Market Making. You may be familiar with the term in terms of the traditional world of finance, but you will definitely need a speed boost to understand where the term is in the DeFi domain.

keytango deep defi for retail investors?

I. dentify trending products:

using our network analysis, financial know-how and investor network, we monitor the Deep Defi ecosystem to identify the most attractive DeFi opportunities in real time and provide guidance on how to optimize returns

2. Smart contract execution:

We implement this strategy through smart contracts that optimize safety, risk-adjusted return on investment (RAROC) and gas costs.

3. simple & relevant UX:

we offer this strategy to retail investors via a simple UX / UI. These strategies are selected by our relevance engine, tailored to specific investor knowledge and risk appetite in a way that enables efficient discovery processes and informed investment decision making.

With the emergence of finance and decentralized applications in our lives, it has become easier for us to manage our investments and savings. The various DEFI applications presented on the DeFi market can be defined as a new set of financial instruments based on decentralized systems and networks: can be presented as an excellent platform that will help solve various problems, which will help you not only save money, but in many cases even increase. keytango projects are the defi good future solution

The exclusivity of DeFi

DeFi is supposed to be inclusive but beyond basic products with fiat-like returns (APR < 10%), discovery and usability are too complex for retail investors. A recent study by Simone Conti (Head of CryptoLab’s Digital Assets Investments), suggests that as few as 500 wallets hold 90% of all DeFi tokens. In order to make DeFi truly inclusive, there needs to be a better way for retail investors to discover and use DeFi products with attractive returns (APR>10%).

Complexity hinders retail adoption

In order to make “crypto kind of returns” (APR > x100%) DeFi investors use sophisticated products and strategies such as flash loans that interact with multiple underlying protocols. In contrast, for retail investors DeFi protocols are often overwhelming even as stand-alone products; the added complexity in using different combinations of protocols is simply prohibiting.

“Retail DeFi” vs. “Attractive DeFi” or in other words “Shallow” vs. “Deep”

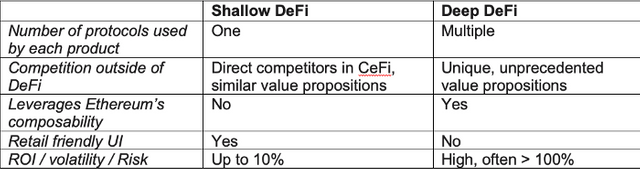

We at keyTango believe that there are currently 2 distinct DeFi eco-systems:

- Shallow DeFi (used by retail)

- Deep DeFi (used by insiders/ professionals)

Shallow DeFi products are used by retail investors to generate up to 10% ROI while Deep products used by professionals, often exceed x100% ROI.

What distinguishes Shallow from Deep is that the former contains products that use only one underlying protocol. Conversely, Deep DeFi contains products that use multiple underlying protocols. An example of shallow DeFi is when an Argent client makes an ETH deposit on Compound Finance. An example of Deep DeFi is yield farming, a strategy often used by DeFi traders, moving assets between different protocols to maximise profits from both interest and token rewards.

Every “Shallow” product has a direct competitor in the CeFi (centralised finance) space.

For example, the value proposition to the retail investor of the CeFi products offered by Nexo, BlockFi and Celsius directly competes with DeFi’s Compound Finance and MakerDao. In contrast, Deep products are unique to DeFi. These are inherently unique and powerful because they leverage Ethereum’s composability trait, that has no preceding in FIAT or CeFi. As described by Linda Xie (managing director at Scalar Capital) “within Ethereum, protocols and applications can easily plug into each other and be combined together to create something entirely new… this is sometimes referred to within the community as “lego pieces.”

The two distinct worlds of DeFi and how retail investors are losing out

The two distinct worlds of DeFi and how retail investors are losing out

TL;DR

- DeFi is supposed to be inclusive but beyond basic products with fiat-like returns (APR < 10%), discovery and usability are too complex for retail investors. This is the leading reason that (1) 95% of all crypto assets still generate no interest and (2) 90% of all DeFi tokens are held by less than 500 wallets.

- “Deep” DeFi products can generate mind-blowing returns (APR > 100%) from crypto and hold game-changing potential if opened up to retail investors. But these products use multiple underlying protocols and are therefore inherently complex.

- keyTango provides an accessible and accommodating platform for retail investors to make sense of deep DeFi products, with tailored discovery, education and investment processes that are personalised for retail investors based on their goals, risk appetite and knowledge of DeFi products.

Players in the market

=> Uniswap

Uniswap was the first true decentralized AMM to enter the market in November 2019. Uniswap allows for anyone to deploy a liquidity pool on the network, and enables any other trader in the ecosystem to contribute liquidity.

=> Balancer

Balancer is considered to be the pioneer of AMMs recently released onto the market. Balancer functions similarly to Uniswap but also offers industry-first, dynamic features that enable the protocol in having a broader arsenal of AMM use-cases.

=> Curve

Another yet fresh AMM protocol to enter the DeFi ecosystem in early 2020 was Curve Finance. Curve has admin-only generated liquidity pools where everyone can contribute to these pools, but they have one big distinction; Curve’s liquidity pools only support stablecoins.

Liquidity Pools

Liquidity pools are pools of tokens that provides liquidity to DEXs. Investors (AKA LP’s) act as market makers, using AMM (automated market making) mechanisms on these exchanges. In its most basic form, liquidity pools keeps a 50:50 value ratio between ETH and a second token

Market Making (MM)

In essence, Market Makers define liquidity and depth indicators in financial markets. They monitor the price of assets they are making in real time and they seize the opposite to the market trend which is often found in an advantageous position. Simply put, when most traders on the market try to sell an asset, market makers would buy it, and when most traders on the market try to buy an asset, market makers would sell it.By doing so, market makers play a regulatory role in asset price while preventing unpredictable spikes in price due to poor liquidity.

conclusion

in my opinion the keytango project is a good solution for future defi. many out there defi projects end badly with investors. and i believe the keytango project is a good project for the future defi

FOR MORE INFORMATION,please reach out to info@keytango.io or our website at https://www.keytango.io/

[1]Analysis: Most DeFi Tokens Are Concentrated In Hands of Top 500 Holders

[2] https://lindajxie.com/2019/09/25/interoperability-and-composability-within-ethereum/

[3] https://www.coindesk.com/defi-fl

For more infor visite us on:

- https://www.keytango.io/

- https://twitter.com/tangokey

- https://t.me/keyTango

- https://medium.com/keytango

Author By Jecxkoplax

Forum Username: Loxalix

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=2458325

Telegram Username: @Loxalix

ETH Wallet Address: 0x3b0BbCaB6F8b611C0AC057BA99E3Cd08a0Ff7e08

Komentar

Posting Komentar